热门推荐

关于我们

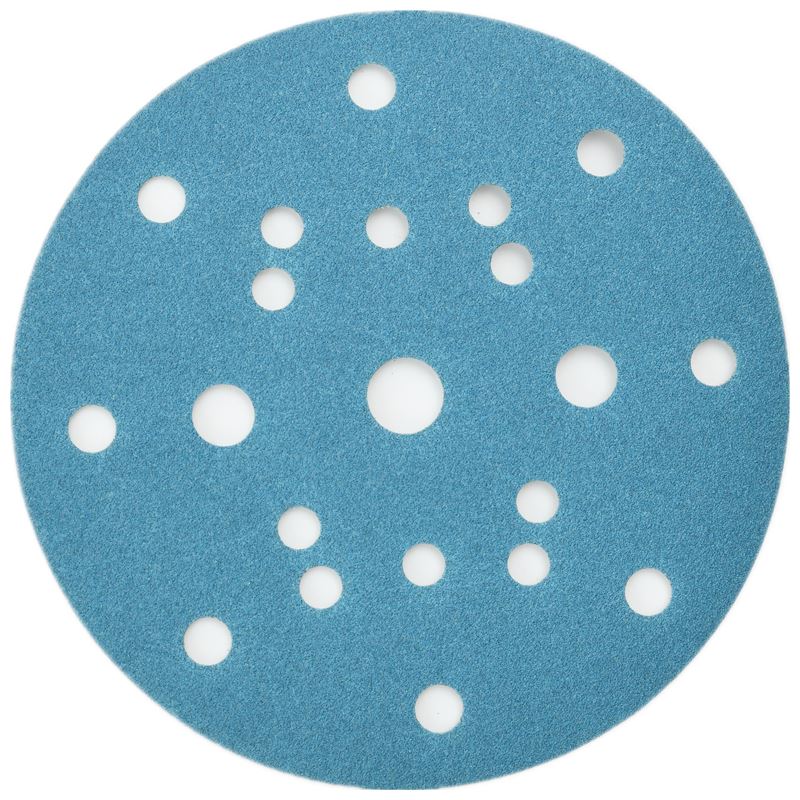

菠菜娱乐平台早在1997年成立"三立行商贸",于2001年成立东升砂布有限公司,地处交通便利、以制造业闻名世界的广东东莞,占地10000余平方米。公司主要从事生产、销售: 薄膜砂纸、精密薄膜砂带、精密研磨卷、背绒/背胶砂纸、平面砂布轮、立式砂布轮、附柄轮、丝轮等系列产品,广泛应用于 超精密研磨、工业研磨抛光、家具美容、汽车美容、装饰装修、美甲 等众多领域。

东升公司近年来实施精品化发展战略,实施流程再造,优化产业链,充分打造企业核心竞争力,找准企业和产品的价值坐标。专注、专心、专一地做大、做强涂附磨具产业,在砂纸与薄膜砂纸研发推广、粘接剂合成、平面轮基体生产、平面轮设备工艺技术研发、营销网络与品牌建设等方面取得了卓有成效的突破,成为目前华南地区集研发、制造、营销完整产业链为一体的高档涂附磨具专业公司之一。

市场需求

根据市场需求,不断推出新品

公司资质

现已拥有39项技术专利,

同时还具有16项的高新技术储备

专业队伍

拥有24年的研发经验,坚信研发的力量

客户服务

稳定的物流合作商,产品安全准时交货

新闻中心

菠菜娱乐平台注册网站